Long-term U.S. Treasury yields have risen, even as inflation data softens. Concerns appear to be rising regarding our country’s fiscal trajectory and debt.

Proposed legislation, including the “Big Beautiful Bill,” points to further spending and borrowing, reinforcing investor concerns about U.S. creditworthiness.

We are also seeing renewed interest in international markets as investors seek diversified opportunities amid shifting global capital flows.

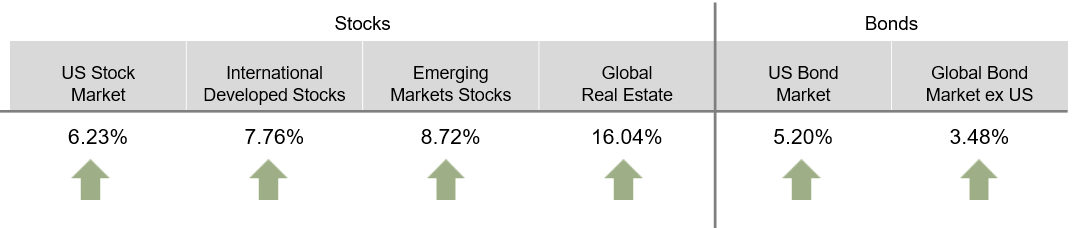

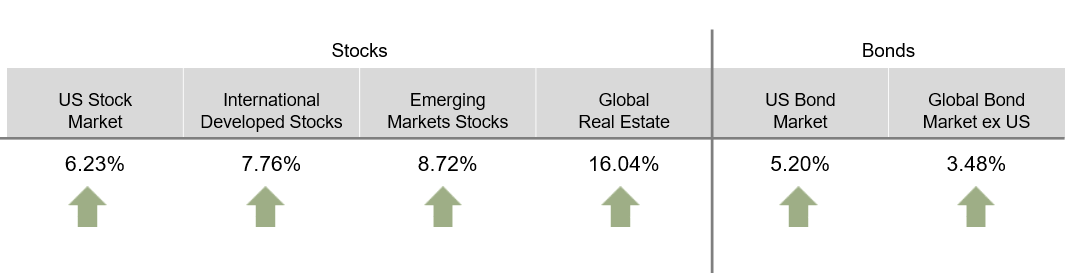

The US equity market posted positive returns for the quarter and underperformed both non-US developed and emerging markets.

US real estate investment trusts underperformed non-US REITs during the quarter.

During the quarter, short- to intermediate-term interest rates decreased, and long-term interest rates increased within the US Treasury market.

US stock markets had an excellent year in 2024 and outperformed international and emerging markets.

The price-to-earnings (P/E) ratio discount of international stocks vs. US stocks is greater today than the 20-year average.

It makes sense to rebalance your portfolio when your stock allocation gets either too far above or below the target allocation.

The US equity market posted positive returns for the quarter and outperformed both non-US developed and emerging markets.

Developed markets outside of the US posted negative returns for the quarter and underperformed the US market, but outperformed emerging markets.

Within the US Treasury market, interest rates generally increased during the quarter.

The US equity market posted positive returns for the quarter and underperformed both non-US developed and emerging markets.

REIT indices outperformed equity market indices.

The Bloomberg Commodity Total Return Index returned +0.68% for the third quarter of 2024.

Cycles of US stock outperformance and underperformance vs. International stocks are normal.

The international equity outperformance from. 2000 to 2009 was especially painful for US investors because US stocks averaged negative returns for 10 years - now known as “The Lost Decade.”

Valuation measures such as price-to-earnings ratios lead some to believe that International stocks may outperform US stocks over the coming yearsmay outperform US stocks over the coming yearsmay outperform US stocks over the coming years

The US equity market posted positive returns for the quarter and outperformed non-US developed markets, but underperformed emerging markets.

The Bloomberg Commodity Total Return Index returned +2.89% for the second quarter of 2024.

Interest rates generally increased across global developed markets for the quarter.

The US equity market posted positive returns for the quarter and outperformed both non-US developed and emerging markets.

Interest rates generally increased in the US Treasury market for the quarter.

US real estate investment trusts outperformed non-US REITs during the quarter.

In only six out of 97 years from 1926 to 2022 did the market have an annual return that came within two percentage points of the market’s long-term average returns of 10%.

It’s extremely important for investors to understand market volatility so they do not get too excited about a “good year” and too worried by a “bad year”.

The allure of trying to be in the market when it’s rising - and out of the market when its falling - is completely understandable. But timing decisions can often result in lower returns and increased stress.

The US equity market posted positive returns for the quarter and outperformed both non-US developed and emerging markets.

US real estate investment trusts outperformed non-US REITs during the quarter.

US government debt reached 121% of the value of the country’s gross domestic product (GDP) last year. Many investors have expressed concern over the impact that servicing this level of debt could have on the stock market. But the historical data show little relation between the two.

The US equity market posted negative returns for the quarter and outperformed non-US developed markets, but underperformed emerging markets

Interest rates increased across all bond maturities in the US Treasury market for the quarter

Emerging markets posted negative returns for the quarter and outperformed both US and non-US developed markets.

In the past century, there have been 15 recessions in the US. In 11 of those instances, stock returns were positive two years after the recession began.

Stock markets typically drop well before a recession is officially announced and then rebound before the recession is officially over.

Commit to holding onto your portfolio’s stock allocation for the long term and rebalancing it if markets drop due to a recession or any other event that may trigger a bear market

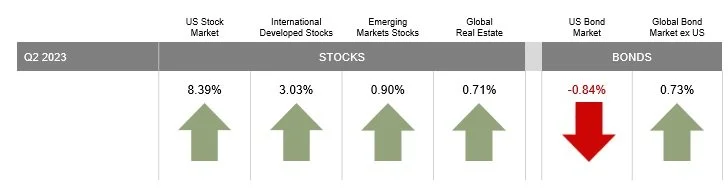

The US equity market posted positive returns for the quarter and outperformed both non-US developed and emerging markets.

US real estate investment trusts outperformed non-US REITs during the quarter.

The Bloomberg Commodity Total Return Index returned -2.56% for the second quarter of 2023.

The US equity market posted positive returns for the quarter and underperformed non-US developed markets, but outperformed emerging markets.

REIT indices underperformed equity market indices.

Across equities, Value and Small caps underperformed Growth and large caps.

The US equity market posted positive returns for the quarter and underperformed both non-US developed and emerging markets

Emerging markets posted positive returns for the quarter and outperformed the US market, but underperformed non-US developed markets.

The Bloomberg Commodity Total Return Index returned +2.22% for the fourth quarter of 2022.

2022 was the seventh worst calendar year loss for the S&P 500 Index since the 1920s, down -18.1%.

The 13% drop in the Aggregate Bond Index for the year was over 10% greater than any other annual drop in this index’s history!

Since 1928, the S&P 500 Index has experienced two or more consecutive negative years just eight times.

The US equity market posted negative returns for the quarter and outperformed both non-US developed and emerging markets.

The Bloomberg Commodity Total Return Index returned -4.11% for the third quarter of 2022.

US real estate investment trusts outperformed non-US REITs during the quarter.

Many parents and grandparent establish 529 plan Education Savings Accounts for their children or grandchildren to help pay for future education expenses. 529 accounts are state sponsored investment plan accounts that offer tax free growth when the funds are used to pay for private K-12 or college expenses.

Read More