Long-term U.S. Treasury yields have risen, even as inflation data softens. Concerns appear to be rising regarding our country’s fiscal trajectory and debt.

Proposed legislation, including the “Big Beautiful Bill,” points to further spending and borrowing, reinforcing investor concerns about U.S. creditworthiness.

We are also seeing renewed interest in international markets as investors seek diversified opportunities amid shifting global capital flows.

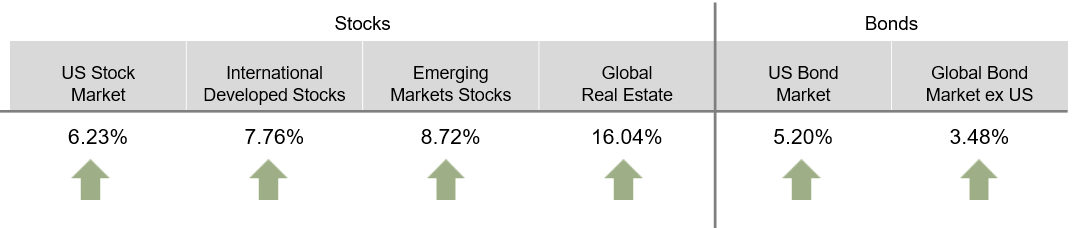

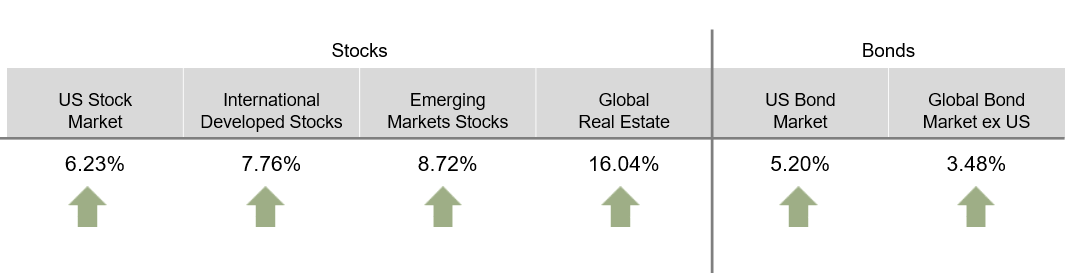

The US equity market posted positive returns for the quarter and underperformed both non-US developed and emerging markets.

US real estate investment trusts underperformed non-US REITs during the quarter.

During the quarter, short- to intermediate-term interest rates decreased, and long-term interest rates increased within the US Treasury market.

The US equity market posted negative returns for the quarter and underperformed both non-US developed and emerging markets.

Developed markets outside of the US posted positive returns for the quarter and outperformed both US and emerging markets.

US real estate investment trusts underperformed non-US REITs during the quarter.

Some are worried that Social Security may not be there when they retire. Even without increasing taxes, the Social Security system is projected to be able to pay 73% of promised benefits all the way out to the year 2098.

The primary source of Social Security funding—payroll taxes—is continuous. As long as people are working, the system collects revenue. Currently, payroll taxes cover about 77-80% of benefit payments even without trust fund reserves.

Unlike private financial schemes, Social Security is backed by the full faith and credit of the U.S. government. Congress has adjusted Social Security multiple times in its history, including the 1983 reforms, which raised the retirement age and increased payroll taxes to stabilize funding. Future adjustments will likely follow a similar path.

US stock markets had an excellent year in 2024 and outperformed international and emerging markets.

The price-to-earnings (P/E) ratio discount of international stocks vs. US stocks is greater today than the 20-year average.

It makes sense to rebalance your portfolio when your stock allocation gets either too far above or below the target allocation.

The US equity market posted positive returns for the quarter and outperformed both non-US developed and emerging markets.

Developed markets outside of the US posted negative returns for the quarter and underperformed the US market, but outperformed emerging markets.

Within the US Treasury market, interest rates generally increased during the quarter.

The US equity market posted positive returns for the quarter and underperformed both non-US developed and emerging markets.

REIT indices outperformed equity market indices.

The Bloomberg Commodity Total Return Index returned +0.68% for the third quarter of 2024.

Review your marginal tax brackets for ordinary income and capital gains rates to decide which account to withdraw from.

Don’t make the mistake of overfunding retirement accounts at the expense of your brokerage (taxable) accounts. It’s important to have non-retirement assets for flexible spending and savings goals. If you haven’t set up a taxable brokerage account, perhaps this is the next move to make for any money leftover that you haven’t found a home for

End of year provides you with the opportunity to think about managing liabilities. Consider the relative advantage to paying down debts with assets. What is the tax impact of doing so? Would it make a difference to your peace of mind?

Cycles of US stock outperformance and underperformance vs. International stocks are normal.

The international equity outperformance from. 2000 to 2009 was especially painful for US investors because US stocks averaged negative returns for 10 years - now known as “The Lost Decade.”

Valuation measures such as price-to-earnings ratios lead some to believe that International stocks may outperform US stocks over the coming yearsmay outperform US stocks over the coming yearsmay outperform US stocks over the coming years

The US equity market posted positive returns for the quarter and outperformed non-US developed markets, but underperformed emerging markets.

The Bloomberg Commodity Total Return Index returned +2.89% for the second quarter of 2024.

Interest rates generally increased across global developed markets for the quarter.

eMoney helps uncover cash or other assets that aren’t working hard for you.

eMoney helps you set and achieve your retirement goals and other objectives such as funding college expenses.

eMoney helps you better understand your position now and how it can be impacted over the years.

The US equity market posted positive returns for the quarter and outperformed both non-US developed and emerging markets.

Interest rates generally increased in the US Treasury market for the quarter.

US real estate investment trusts outperformed non-US REITs during the quarter.

In only six out of 97 years from 1926 to 2022 did the market have an annual return that came within two percentage points of the market’s long-term average returns of 10%.

It’s extremely important for investors to understand market volatility so they do not get too excited about a “good year” and too worried by a “bad year”.

The allure of trying to be in the market when it’s rising - and out of the market when its falling - is completely understandable. But timing decisions can often result in lower returns and increased stress.

The US equity market posted positive returns for the quarter and outperformed both non-US developed and emerging markets.

US real estate investment trusts outperformed non-US REITs during the quarter.

US government debt reached 121% of the value of the country’s gross domestic product (GDP) last year. Many investors have expressed concern over the impact that servicing this level of debt could have on the stock market. But the historical data show little relation between the two.

Your financial life is complicated, and it pays to automate and simplify it.

While automation can streamline our finances, it’s essential to monitor your accounts regularly to detect any irregularities and ensure everything is running smoothly.

The US equity market posted negative returns for the quarter and outperformed non-US developed markets, but underperformed emerging markets

Interest rates increased across all bond maturities in the US Treasury market for the quarter

Emerging markets posted negative returns for the quarter and outperformed both US and non-US developed markets.

In the past century, there have been 15 recessions in the US. In 11 of those instances, stock returns were positive two years after the recession began.

Stock markets typically drop well before a recession is officially announced and then rebound before the recession is officially over.

Commit to holding onto your portfolio’s stock allocation for the long term and rebalancing it if markets drop due to a recession or any other event that may trigger a bear market

The US equity market posted positive returns for the quarter and outperformed both non-US developed and emerging markets.

US real estate investment trusts outperformed non-US REITs during the quarter.

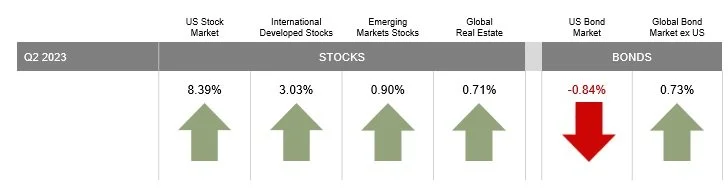

The Bloomberg Commodity Total Return Index returned -2.56% for the second quarter of 2023.