The complete guide to buying solar panels for your home

Here is a complete guide to buying solar panels for your home in which we cover many of the commonly asked questions.

Read More

Protect Your Personal Liability while Serving on a Homeowners’ Association Board

The tragic loss of life from collapse of the Champlain Towers South in Surfside Florida should be a wake-up call to condo boards across the country. Being on a Homeowners‘ Association (HOA) board is a serious job that comes with it a high degree of responsibility. Board members need to ensure the safety of residents as well as protect themselves. Here are five things you can do to help protect yourself from personal liability while serving on a HOA Board.

Read More

Ellen Li becomes a partner at Financial Alternatives

I am proud to announce that Ellen is now a Shareholder Partner with Financial Alternatives. She has been with us for over eleven years, and we are excited that she has achieved this next step with the firm.

Read More

Ten ways to help your executor - now!

When you draw up your estate planning documents or your will, you will be asked to name an executor to handle your estate and distribute your property when you die. Here are 10 ways to help your executor now.

Read More

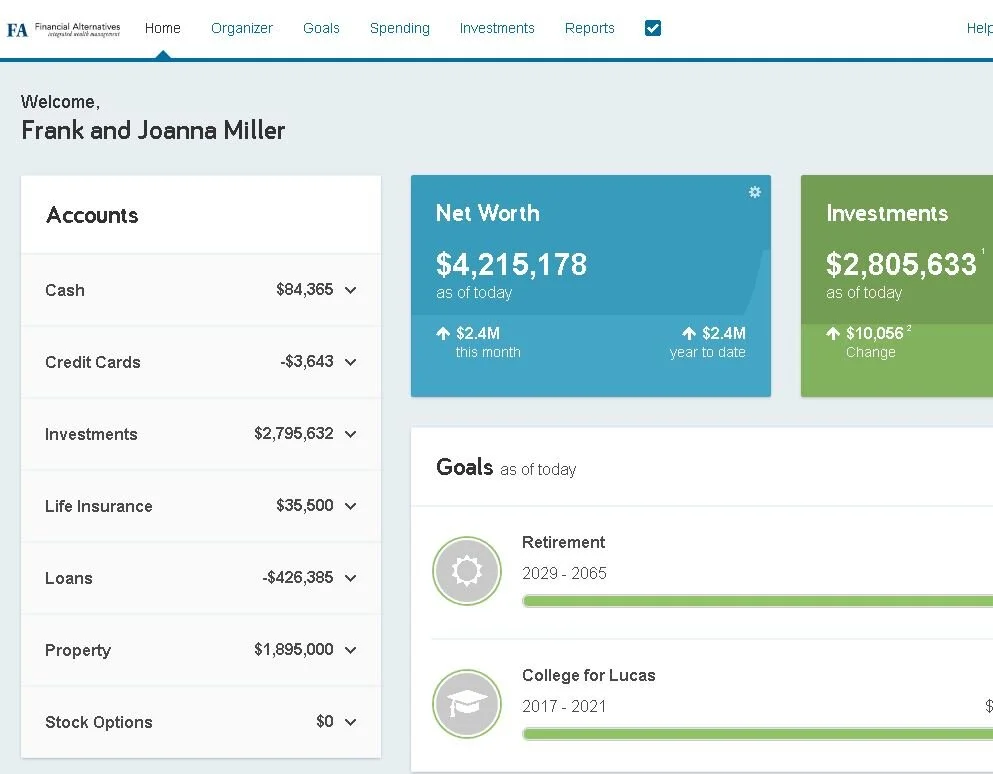

User Guides for Your eMoney Financial Dashboard

More and more of our clients are using their eMoney Financial Dashboard to get a single, consolidated view of their financial picture. Use these PDF guides to help you get the most out of the site - from just signing up to using advanced features.

Read More

2020 Supplemental Tax Information Resources

Resources that may help you prepare your 2020 tax return. This includes links to third-party investment company information to calculate tax-exempt income at the state level or foreign taxes paid (which may offset a shareholder’s tax liability).

Read More

Step up in basis and community property states – don’t make this mistake!

In this blog we cover the basics of how step up in basis works in a community property state such as California, and what the common mistakes are that people make (that should be avoided).

Read More

Prop 19 and how it impacts inherited property for California residents

Prop 19 has significant impact for residents of the state of California who are looking to pass on property as an inheritance.

Read More

2021 California small business relief programs: explained

Business owners in the state of California who have been hit hard by the pandemic may avail themselves of the resources that the government has made available to them. In this blog we will discuss the major California relief programs available for small businesses.

Read More

Step-up in cost basis: What California residents need to know

In this blog, we are going to discuss what California residents need to know about step-up in cost basis.

Read More