Develop the habit of reviewing your estate planning documents and beneficiary designations on a regular basis. We recommend doing this at least every two to five years at a minimum and always after any significant life event.

Even a young adult should have the following estate planning documents: Advanced Health Care Directive, Financial Power of Attorney, Beneficiaries for accounts, Last Will and a Digital Will.

The US equity market posted negative returns for the quarter and outperformed both non-US developed and emerging markets.

The Bloomberg Commodity Total Return Index returned -4.11% for the third quarter of 2022.

US real estate investment trusts outperformed non-US REITs during the quarter.

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch

Make sure you have enough cash and other conservative investments so you will never have to sell stocks in a bear market even a prolonged bear market.

Expect stock markets to fall further after you rebalance, in other words mentally prepare for this so you will not be overly bothered by it.

US mortgage rates hit 5% for first time since 2011.

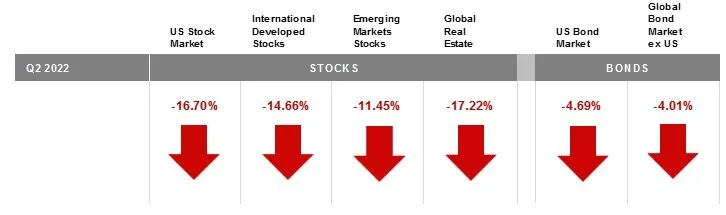

The US equity market posted negative returns for the quarter and underperformed both non-US developed and emerging markets.

The Bloomberg Commodity Index Total Return returned -5.66% for the second quarter of 2022.

While volatile periods like the one we’re experiencing now can be intense, investors who learn to embrace uncertainty may often triumph in the long run.

One early retirement study noted that a withdrawal rate of 4% is relatively safe.

Many researchers have evaluated withdrawal rates and related issues since then - proposing adjustments to the traditional 4% rule.

One such proposal, the Target Percentage Adjustment (TPA) suggests modifying your withdrawals year by year.

Being flexible in the face of market downturns and inflation can allow you to increase your withdrawals in retirement.

Emerging markets posted negative returns for the quarter, underperforming the US and non-US developed equity markets.

The US equity market posted negative returns for the quarter and underperformed non-US developed markets, but outperformed emerging markets.

The Bloomberg Commodity Index Total Return returned +25.55% for the first quarter of 2022.

Vanguard’s 10-year forecast for U.S. equity returns is 2.3% to 4.3% per year; and for global equities it’s higher at 5.2% to 7.2% per year.

Market corrections are a good time to rebalance your portfolio and add back to stock holdings.

History shows that reaching a new market high doesn’t mean the market will then retreat.

It is wise to have a plan in place for the possibility of reduced future investment returns.

Emerging markets fell 2.5% for the year, underperforming both US and non-US developed equity markets.

The Bloomberg Commodity Index Total Return returned -1.56% for the fourth quarter of 2021.

Interest rate movements in the US Treasury fixed income market were mixed during the fourth quarter.

Single taxpayers with taxable income less than $400,000 and married filing jointly (MFJ) taxpayers with taxable income less than $450,000 should not see much change in the taxes they pay as a result of the changes under the new Biden tax plan.

Some taxpayers with income below $400,000 and $450,000 could see tax reductions due to the return of the state and local tax deduction.

If your income is above this $400,000 and $450,000, expect your taxes to go up.

The US equity market was flat for the quarter and outperformed non-US developed markets and emerging markets

In emerging and developed markets, most currencies depreciated vs. the US dollar

The Bloomberg Commodity Index Total Return returned 6.59% for the third quarter of 2021.

Staying diversified and disciplined, avoiding market timing, and maintaining a long-term investment perspective is a better course of action.

Market timing is the attempt to own stocks when they are rising, sell them high before they fall, and buy them back at lower prices before they rise again.

Understanding the history of bear markets and maintaining a long-term focus helps investors remain calm and take appropriate action during corrections.

Equity markets around the globe posted positive returns in the second quarter. Looking at broad market indices, US and non-US developed markets outperformed emerging markets for the quarter

Emerging markets posted positive returns for the quarter, underperforming the US and non-US developed equity markets.

In developed markets, several currencies appreciated vs. the US dollar, but some, notably the Australian dollar, depreciated. In emerging markets, most currencies appreciated vs. the US dollar, but some, notably the Turkish lira, depreciated.

Life Insurance is not complicated. It was made confusing by those that profit from this confusion

Every policy is either term insurance or term insurance attached to a savings/investment

Insurance is for dying, investments are for living; don’t combine the two.

By combining insurance with investments, it is harder to get the cheapest insurance and optimal investment selections.

The US equity market posted positive returns for the quarter and outperformed non-US developed markets and emerging markets.

US real estate investment trusts outperformed non-US REITs during the quarter.

The Bloomberg Commodity Index Total Return returned 6.92% for the first quarter of 2021

In the face of a global pandemic, stock and bond markets performed surprisingly well in 2020.

Last year investors experienced one of the swiftest drops and subsequent full recoveries in stock market history.

We took advantage of the correction and rebalanced portfolios in March when the market was low. We also took advantage of market lows by executing tax-saving tax swap trades.

Equity markets around the globe posted positive returns in the fourth quarter. Looking at broad market indices, emerging markets outperformed non-US developed markets and US equities.

REIT indices underperformed equity market indices in both the US and non-US developed markets.

The Bloomberg Commodity Index Total Return returned 10.19% for the fourth quarter of 2020.

Tax code changes often take place after major elections in which one party replaces the other.

The Biden tax plan has pledged not to increase taxes on taxpayers earning less than $400,000 a year.

It proposes to eliminate the step-up in cost basis on assets at death.

It is important to be familiar with the current tax code and any changes that may be enacted so you can plan accordingly.

Equity markets around the globe posted positive returns in the third quarter. Looking at broad market indices, emerging markets equities outperformed US and non-US developed markets for the quarter.

Value underperformed growth across regions. Small caps outperformed large caps in non-US developed and emerging markets but underperformed in the US.

REIT indices underperformed equity market indices in both the US and non-US developed markets.